As a business owner, managing payroll can be one of your most significant responsibilities. From ensuring that employees are paid accurately and on time to making sure your business complies with tax laws, payroll processing is no easy task. One essential tool that can streamline this process is a check stub maker. This simple but powerful tool can help employers manage payroll more efficiently and save time, money, and effort.

In this blog, we will explore why check stub makers are a great investment for employers. We’ll cover the benefits, the ease of use, and how this tool can improve the accuracy and transparency of your payroll system. Whether you are running a small business or a growing company, understanding the value of a check stub maker can help you make informed decisions about how to manage your payroll processes.

What Is a Check Stub Maker?

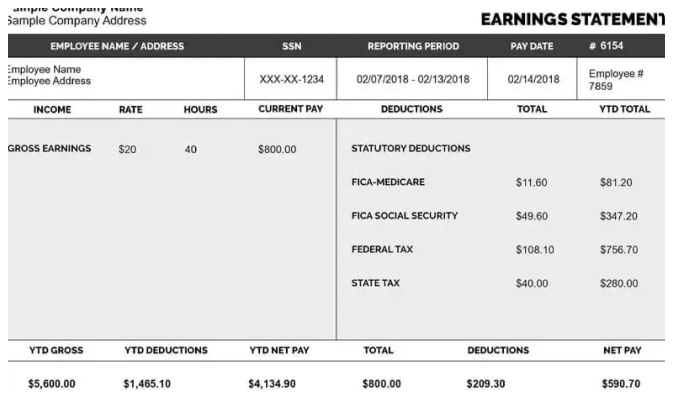

A check stub maker is a digital tool or software that allows employers to create detailed pay stubs for their employees. A pay stub contains information about an employee’s earnings, deductions, taxes, and net pay. The check stub maker automates the creation of these pay stubs and allows business owners and HR departments to generate them quickly and accurately. It simplifies the payroll process and ensures that employees have clear, transparent records of their compensation.

The software often allows employers to customize the pay stub template, including sections for various deductions like taxes, insurance, and retirement contributions. The check stub maker can also calculate totals, ensuring that all numbers are accurate and in compliance with tax laws.

The Benefits of Using a Check Stub Maker

1. Saves Time and Reduces Errors

One of the biggest challenges in payroll processing is ensuring accuracy. Manually calculating payroll, applying deductions, and creating pay stubs is time-consuming and can lead to errors. Mistakes in pay can result in employee dissatisfaction, legal issues, and additional time spent fixing problems.

A check stub maker simplifies the process by automating these calculations. The software automatically computes gross pay, taxes, deductions, and net pay based on the information you input. This significantly reduces the risk of errors and saves you valuable time.

With a check stub maker, you can generate pay stubs in minutes instead of hours, which frees up your time to focus on other important aspects of your business. Whether you have one employee or hundreds, the tool can handle the calculations quickly and efficiently.

2. Improves Accuracy and Consistency

Accuracy in payroll is crucial, and errors can lead to costly consequences. Incorrect pay can damage employee trust, lead to tax penalties, and even result in legal issues. A check stub maker ensures accuracy by automating the calculations and reducing the likelihood of human error.

The software uses preset tax tables and deduction rules, which helps ensure compliance with federal, state, and local tax regulations. Whether you are calculating overtime, bonuses, or various deductions, the check stub maker applies the correct formulas every time. This consistency leads to reliable and accurate pay stubs for your employees.

3. Enhances Employee Satisfaction and Trust

Employees rely on their pay stubs to understand how their salary is being calculated, including their gross pay, deductions, and the net pay they receive. Clear and accurate pay stubs foster transparency and trust between employers and employees. When employees can easily understand their pay stubs, it reduces confusion and helps them feel confident in the payroll process.

With a check stub maker, you can provide employees with professional-looking pay stubs that include all the necessary details, such as tax withholdings, retirement contributions, benefits, and bonuses. This transparency not only boosts employee morale but also improves your company’s reputation as an honest and reliable employer.

4. Ensures Legal Compliance

There are a variety of labor laws and tax regulations that businesses must comply with, including wage laws, tax withholdings, and benefits deductions. Non-compliance can lead to fines, penalties, and legal disputes. Ensuring that your payroll system follows the rules can be difficult, especially when there are frequent changes in laws.

A check stub maker helps businesses stay compliant by automatically applying the correct tax rates and ensuring that all deductions are accurately calculated. Many check stub makers are updated regularly to reflect changes in tax laws, making it easier for businesses to remain compliant without worrying about missed updates or errors.

Additionally, pay stubs serve as important documentation for tax purposes. By using a check stub maker, you can create records that are easy to store, share, and access during audits or tax filing season.

5. Customizable Pay Stubs

Every business has unique payroll needs. Some companies offer a variety of benefits, bonuses, and deductions that need to be clearly documented on their employees’ pay stubs. A free check stub maker allows for a high degree of customization. You can modify the pay stub to include specific information relevant to your business and industry.

For example, if your company offers performance bonuses or has special deductions for healthcare, retirement, or union dues, you can easily customize the pay stub template to reflect these changes. The check stub maker will automatically apply the customized fields to each employee’s pay stub, ensuring consistency and accuracy across the board.

6. Paperless and Eco-Friendly

In today’s digital age, businesses are increasingly adopting paperless practices to reduce waste and improve efficiency. A check stub maker allows employers to create electronic pay stubs that can be emailed to employees or stored in digital files. This eliminates the need for printing physical pay stubs and reduces the associated costs, such as paper, ink, and postage.

By going paperless, you not only reduce costs but also contribute to a more sustainable business practice. Additionally, digital pay stubs are easier to organize, search, and retrieve when needed, which can save time in the long run.

7. Secure and Accessible Records

Another key benefit of using a check stub maker is the secure storage of pay stubs. Digital pay stubs can be saved and stored in the cloud or other secure online platforms, making them easily accessible to both employers and employees. If employees need to reference a past pay stub, they can simply log in to their online account to access it.

Using a check stub maker ensures that your records are protected from physical damage, theft, or loss. Moreover, since these records are digital, they can be easily backed up to prevent data loss.

8. Cost-Effective Solution

For small businesses and startups, managing payroll in-house can be costly. Hiring an accountant or payroll specialist to handle pay stubs can be expensive, especially for a business with a small team.

A check stub maker is a more cost-effective alternative, especially for small and medium-sized businesses. With affordable subscription plans and no need for additional staff, the check stub maker can save businesses money while improving payroll efficiency.

Instead of paying for an accountant to manually process payroll and create pay stubs, you can use a check stub maker to automate the process. This reduces overhead costs and allows businesses to allocate their budget to other critical areas.

9. Easy Integration with Payroll Software

A check stub maker often integrates seamlessly with existing payroll systems and accounting software. This means you can upload employee data from your payroll system directly into the check stub maker, reducing the time spent manually inputting information.

This integration ensures that your payroll data is consistent across all platforms and that there is no duplication of effort. Additionally, it allows you to create and manage pay stubs without needing to switch between multiple systems or platforms.

How to Choose the Right Check Stub Maker for Your Business

While there are many check stub makers available, it’s important to select one that suits the unique needs of your business. Here are a few things to consider when choosing a check stub maker:

- Ease of Use: Choose a user-friendly tool that doesn’t require specialized knowledge to operate. The simpler, the better.

- Customization Options: Ensure the software allows for customization to suit your business’s payroll structure and needs.

- Compliance: Look for a check stub maker that keeps up with tax laws and deductions to ensure compliance.

- Security: The software should offer secure storage options for pay stubs and other sensitive payroll data.

- Support: Choose a service that offers customer support in case you run into any issues or need assistance with payroll.

Conclusion

Investing in a check stub maker is one of the smartest decisions employers can make to streamline their payroll process. This tool saves time, reduces errors, and enhances transparency and compliance. It also helps create customizable, professional pay stubs that can be shared digitally, reducing costs and contributing to a more sustainable business practice.

Whether you’re a small business owner or managing a larger team, a check stub maker is a cost-effective, efficient solution to payroll management. By adopting this tool, you can ensure your employees are paid accurately and on time while also freeing up valuable time and resources to grow your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply