Running a business, especially a small or growing startup, comes with many responsibilities, and one of the most important is managing payroll. Payroll is critical to keeping employees happy, ensuring they are paid correctly and on time, and maintaining legal compliance. However, handling payroll can be complicated, time-consuming, and costly—especially when you’re trying to scale your business.

In the past, payroll required specialized knowledge and often led to high costs for small business owners. Fortunately, the rise of free paycheck maker is revolutionizing the way payroll is managed, especially for startups and small businesses. These tools automate payroll processes, making them more accessible, efficient, and affordable. In this blog, we will explore how free paycheck creators are changing the payroll landscape, why they are essential for startups, and how they benefit both employers and employees.

What Is a Free Payroll Check Maker?

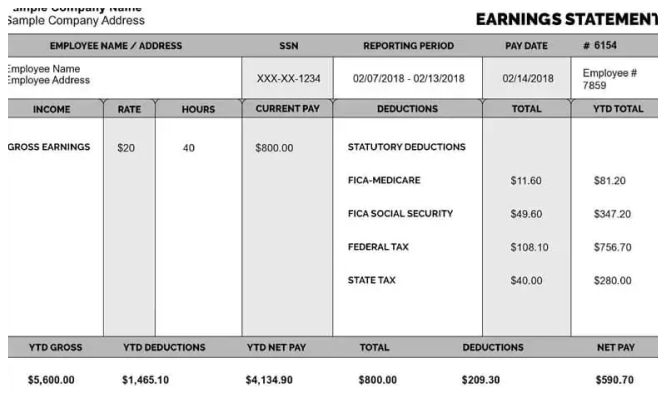

A free payroll check maker is an online tool or software that helps businesses generate paychecks for their employees, all without the need to pay for expensive payroll services. These tools offer essential payroll functions like calculating employee wages, tax withholdings, and deductions. They can also generate pay stubs, ensure tax compliance, and offer payroll reports—all at no cost.

The “free” aspect is especially appealing to startups and small businesses that might not have the budget for paid payroll services or a dedicated HR team. By providing these essential features for free, payroll check makers help business owners focus on growing their business without worrying about payroll errors or compliance issues.

Why Free Payroll Check Makers Are a Game Changer

Managing payroll effectively is a critical aspect of any business operation. But for startups, handling payroll can feel overwhelming. Many entrepreneurs try to manage payroll themselves but find the task too complex and time-consuming. Here’s why free paycheck creators are such a game changer for businesses of all sizes:

1. Cost Savings for Small Businesses

For small businesses and startups, controlling costs is essential. Using a paid payroll service can quickly add up, especially when the business is just starting out. Free payroll check makers allow business owners to manage payroll without spending money on expensive software or payroll services.

By offering essential payroll functionalities for free, these tools give businesses a cost-effective way to stay compliant with tax laws, handle employee pay, and create paychecks. For startups with tight budgets, this is an invaluable resource that keeps payroll simple and affordable.

2. User-Friendly and Time-Saving

Traditionally, payroll processes were manual, and business owners or HR teams had to calculate taxes, deductions, and wages on their own. This could take hours, particularly if the business had several employees. A free paycheck creator streamlines the entire payroll process, allowing businesses to generate paychecks and pay stubs quickly and easily.

Many of these tools are designed to be user-friendly, even for business owners who aren’t accounting experts. The process is often as simple as entering employee details, wages, and deductions, and letting the tool do the rest. Payroll check makers save valuable time that business owners can use to focus on growing their business instead of spending hours on payroll calculations.

3. Tax Compliance Made Easy

Navigating the complex world of tax laws is one of the most challenging aspects of payroll. Payroll requires businesses to calculate federal, state, and local taxes, which can vary based on location, employee status, and benefits. Failing to calculate taxes accurately can lead to hefty penalties and legal trouble.

Fortunately, free payroll check makers often include automatic tax calculations, ensuring that businesses stay compliant with all relevant tax laws. These tools can automatically calculate tax withholdings, apply the correct tax rates, and generate tax forms like W-2s for employees. By automating these processes, these tools help businesses avoid errors and reduce the risk of tax-related issues.

4. Transparency and Trust with Employees

One of the best ways to build trust with employees is by providing them with clear, transparent pay information. Employees want to know that they’re being paid fairly and that their paychecks reflect their actual work.

Free paycheck creators help promote transparency by generating detailed pay stubs that break down gross wages, taxes, deductions, and net pay. This not only makes the payment process clearer for employees but also shows them that the business is committed to paying them accurately. Transparent pay practices contribute to employee satisfaction and reduce the chances of payroll disputes.

5. Scalability as Your Business Grows

Startups often experience rapid growth, and the complexity of payroll can increase significantly as you hire more employees. Tracking payroll manually becomes much more difficult as the business expands, especially if you’re hiring people in different locations or offering more benefits.

The beauty of free payroll check makers is that they can scale with your business. Even as your employee count increases, these tools can handle the additional payroll tasks, such as calculating new tax rates for different locations or accounting for new benefits packages. As your startup grows, you won’t need to switch payroll systems or hire additional employees to handle payroll; the free paycheck creator can grow alongside your business.

6. Accuracy and Reduced Risk of Errors

Handling payroll manually can lead to errors in tax calculations, wage payments, or deductions. Even a minor mistake can cause issues, ranging from employee dissatisfaction to fines from the IRS.

A free paycheck creator significantly reduces the risk of errors. By automating payroll calculations, these tools ensure that all amounts are correct and comply with tax regulations. The software does the math for you, which reduces human error and makes sure that your employees are paid accurately and on time.

How to Use a Free Payroll Check Maker

Using a free paycheck creator is generally a straightforward process. Here’s a quick guide on how to get started:

Step 1: Choose a Free Paycheck Creator

There are many free payroll check makers available online. Some of the most popular ones include:

- Wave Payroll – Offers payroll processing for free if you only have one employee.

- Payroll4Free – Provides free payroll services for up to 25 employees, including tax calculation and paycheck generation.

- HR.my – This cloud-based tool offers free payroll processing, unlimited employees, and tax filing features.

Look for a tool that best fits your business size and payroll needs.

Step 2: Set Up Employee Information

To get started, you’ll need to input your employees’ details into the system. This includes their names, addresses, pay rates, tax exemptions, and deductions for benefits like healthcare or retirement savings. Most free paycheck creators will provide a step-by-step guide to help you set this up.

Step 3: Enter Hours Worked (for Hourly Employees)

For hourly employees, you’ll need to input the number of hours worked during the pay period. Some tools allow employees to track their hours and submit them directly into the system.

Step 4: Generate Paychecks

Once all the information is entered, the paycheck creator will automatically calculate the wages, deductions, and taxes for each employee. You can then generate pay stubs or paychecks, which can be printed or sent electronically to employees.

Step 5: Review and Submit Payroll

Before finalizing payroll, review the generated paychecks to ensure everything is correct. Once reviewed, you can submit payroll, process payments via direct deposit, or print checks for employees.

Step 6: Stay Compliant with Taxes

Most free paycheck creators will help you comply with tax regulations by generating required tax forms (like W-2s) and providing reports for IRS filing. You can use these forms to file your taxes or share them with your accountant.

Best Practices for Using Free Payroll Check Makers

While free paycheck creators are powerful tools, it’s important to follow best practices to get the most out of them:

-

Keep Records Organized: Make sure to maintain accurate records of your employee data, work hours, and payroll information. This ensures smooth payroll processing and compliance with tax laws.

-

Review Payroll Regularly: Even though the tool automates many processes, it’s important to regularly check your payroll data to ensure everything is accurate.

-

Stay Updated on Tax Laws: Tax regulations can change frequently, so it’s essential to stay informed. Many paycheck creators update their software automatically to reflect new tax rates, but it’s still a good idea to review any changes to ensure compliance.

-

Use Direct Deposit When Possible: Direct deposit is faster and more secure than issuing paper checks. Most paycheck creators offer direct deposit features, so take advantage of this option to streamline payroll.

Conclusion

Free payroll check makers are revolutionizing how businesses handle payroll, particularly for startups and small businesses. They offer a cost-effective, accurate, and time-saving way to manage payroll without the need for expensive software or extensive HR resources. By automating tax calculations, payroll deductions, and paycheck generation, these tools help ensure compliance, reduce errors, and increase transparency for employees.

As your business grows, you may eventually need to invest in more robust payroll systems, but starting with a free paycheck creator is an excellent way to simplify your payroll process without breaking the bank. Whether you’re a solopreneur or have a small team, these tools are a game-changer for growing businesses that want to keep payroll simple, accurate, and efficient.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Leave a Reply