Managing payroll can be a time-consuming task for businesses and freelancers alike. Whether you’re a small business owner, an independent contractor, or an HR professional, ensuring accurate and timely paystub generation is crucial. Thanks to modern technology, tools like paystub creators simplify the process, making payroll management more efficient than ever. This article will guide you through using a paystub creator and explain why it’s an essential tool for seamless payroll. Let’s dive into everything you need to know.

What is a Paystub Creator?

A paystub creator is an online tool designed to generate professional and accurate paystubs for employees, contractors, and self-employed individuals. These tools are user-friendly, cost-effective, and customizable, catering to a wide range of payroll needs. Paystub creators are particularly useful for:

-

Small business owners who manage payroll independently.

-

Freelancers and gig workers needing proof of income.

-

Contractors looking to maintain detailed financial records.

Why Are Paystubs Important?

Paystubs are essential documents that provide a detailed breakdown of an individual’s earnings and deductions. They serve multiple purposes, including:

-

Proof of Income: Paystubs are often required for securing loans, renting properties, or applying for credit.

-

Tax Filing: Accurate paystubs simplify tax preparation by providing a clear record of income and deductions.

-

Financial Planning: Employees and freelancers can use paystubs to track earnings and manage budgets effectively.

-

Compliance: Businesses are often required by law to provide paystubs to employees, ensuring transparency in payroll.

Key Features of a Paystub Creator

Modern paystub creators, such as Real Check Stubs, offer a variety of features that make payroll management effortless. Here’s what you can expect:

-

Customizable Templates: Tailor paystubs to include business logos, employee details, and other personalized elements.

-

Accurate Calculations: Automatically calculate gross pay, deductions, taxes, and net pay to ensure precision.

-

Quick Generation: Create professional paystubs in minutes, saving time and effort.

-

Accessibility: Many tools are cloud-based, allowing users to generate paystubs anytime, anywhere.

-

Compliance with Local Laws: Ensure that paystubs meet legal requirements in the U.S., including detailed breakdowns of earnings and deductions.

How to Use a Paystub Creator for Seamless Payroll

Using a paystub creator is a straightforward process. Follow these simple steps to generate professional paystubs:

Step 1: Choose a Reliable Paystub Creator

Start by selecting a trusted paystub creator, such as Real Check Stubs. Look for a tool that offers:

-

User-friendly interface

-

Customization options

-

Secure payment processing

-

Positive reviews from users

Step 2: Enter Basic Information

Input the necessary details, including:

-

Employer name and contact information

-

Employee or contractor details (name, address, job title)

-

Pay period and payment date

Step 3: Add Earnings and Deductions

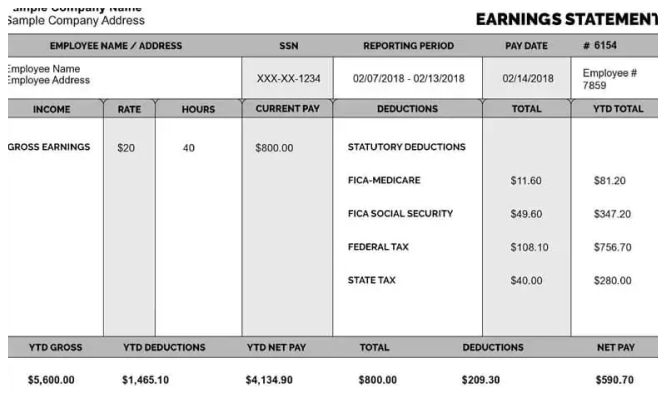

Specify the gross earnings for the pay period. Include deductions such as:

-

Federal, state, and local taxes

-

Social Security and Medicare contributions

-

Health insurance or retirement plan contributions

The paystub creator will automatically calculate the net pay based on these inputs.

Step 4: Review and Customize

Before finalizing, review the paystub for accuracy. Customize it with your business logo or any additional details to ensure a professional appearance.

Step 5: Download and Share

Once satisfied, download the paystub as a PDF or print it directly. Share the document with employees or retain it for your records.

Benefits of Using a Paystub Creator

Paystub creators simplify payroll processes and offer several advantages:

-

Time-Saving: Automating calculations and template generation reduces manual effort.

-

Cost-Effective: Many tools, including Real Check Stubs, are affordable and eliminate the need for expensive payroll software.

-

Professional Results: High-quality, customizable paystubs enhance your business’s credibility.

-

Error Reduction: Automated calculations minimize the risk of errors in payroll.

-

Record Keeping: Easily maintain organized records for tax filing and audits.

Who Can Benefit from a Paystub Creator?

A paystub creator is a versatile tool suitable for various audiences:

-

Small Business Owners: Streamline payroll without hiring dedicated HR staff.

-

Freelancers and Gig Workers: Generate proof of income for personal or professional purposes.

-

Contractors: Maintain detailed payment records to simplify tax filing.

-

HR Professionals: Automate paystub generation to focus on strategic tasks.

Real Check Stubs: A Trusted Paystub Creator

Among the many options available, Real Check Stubs stands out for its reliability and ease of use. Here’s why:

-

User-Friendly Design: Navigate effortlessly through the paystub creation process.

-

Comprehensive Features: Enjoy customizable templates, accurate calculations, and secure storage.

-

Affordable Pricing: Access professional tools without breaking the bank.

-

Positive Reputation: Trusted by thousands of users across the U.S.

Common Questions About Paystub Creators

Are Paystub Creators Legal?

Yes, paystub creators are legal when used to generate accurate and truthful documents. Misusing them to create fake paystubs for fraudulent purposes is illegal and punishable by law.

Can Paystub Creators Handle Taxes?

Most paystub creators are equipped to calculate federal, state, and local taxes automatically. However, always verify the tax rates to ensure compliance.

Do Paystub Creators Store My Data?

Reputable paystub creators prioritize data security. Tools like Real Check Stubs use encryption to protect user information.

Final Thoughts

A paystub creator is an indispensable tool for businesses, freelancers, and contractors seeking to simplify payroll. With features like automated calculations, customizable templates, and secure access, tools like Real Check Stubs make generating paystubs effortless. By adopting this technology, you can save time, reduce errors, and maintain compliance with payroll regulations. Start using a paystub creator today to experience seamless payroll management!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply