For self-employed individuals in the United States, managing taxes can be a challenging and often stressful task. Unlike employees who receive paychecks with tax deductions automatically made by their employers, self-employed people must handle their taxes on their own. This includes calculating income, tracking expenses, and ensuring the correct amount of taxes are paid.

One tool that can significantly simplify the tax filing process for self-employed individuals is the use of check stubs. While many self-employed people don’t receive traditional paychecks, check stubs can still be an essential tool in organizing income and tracking deductions. In this blog, we’ll explore how check stubs can help self-employed individuals file taxes more efficiently, minimize errors, and stay on top of their financial responsibilities.

What Are Check Stubs and Why Are They Important?

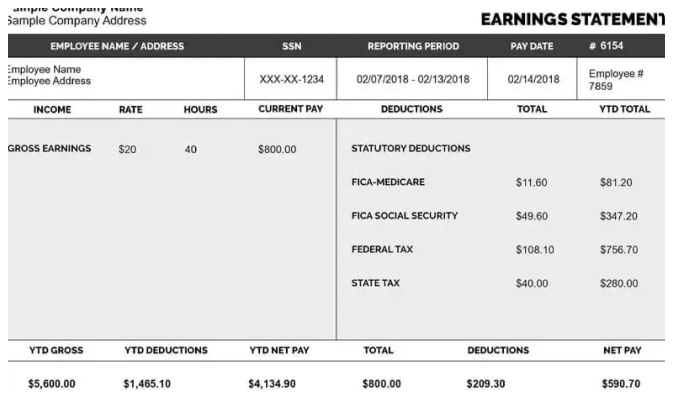

A check stub is a document that provides a breakdown of an individual’s pay for a specific period. It typically includes details such as gross income, taxes, deductions (such as health insurance or retirement contributions), and the final net pay amount. While check stubs are commonly associated with employees who receive regular paychecks, they can also be useful for self-employed individuals, especially when they are managing their own business income and expenses.

For self-employed individuals, a check stub is a valuable tool for documenting income, making it easier to track what’s been earned and how much needs to be paid in taxes. Even though you may not be getting a paycheck from an employer, you can still generate check stubs for yourself or your business to help organize your finances and prepare for tax season.

How Check Stubs Help with Tax Filing

Tax filing as a self-employed person is different from filing taxes as an employee, primarily because you are responsible for both your income tax and self-employment tax (which covers Social Security and Medicare). This makes accurate record-keeping essential for ensuring you don’t pay more than you owe and that you maximize deductions available to you.

Here’s how check stubs can help self-employed individuals manage their taxes more efficiently:

1. Clear Record of Income

The first step in tax filing is knowing exactly how much money you earned throughout the year. Self-employed individuals often have irregular income from different sources, whether it’s clients, freelance projects, or sales of products or services. Without a paycheck to rely on, it can be easy to lose track of income.

By using check stubs, you can generate detailed records of your income each time you receive a payment. A check stub can itemize your earnings by date, project, or client, which makes it much easier to tally up your income when it’s time to file taxes. With clear records, you’ll have a much easier time reporting your income accurately on your tax return, reducing the risk of underreporting and potential penalties.

2. Separation of Business and Personal Income

Many self-employed individuals struggle to keep their business and personal finances separate. This can lead to confusion when it comes to tax time. Having check stubs that document only your business income helps you maintain clear boundaries between personal and business earnings.

When you generate check stubs for your business, you can create a more structured approach to your finances, making it easier to track your business’s income separately from personal income. This separation is crucial for tax purposes, as it allows you to report business income accurately and claim appropriate deductions, like business expenses or home office deductions.

3. Tracking Deductions and Expenses

Self-employed individuals are eligible for a wide range of tax deductions, including expenses related to running a business. This can include things like office supplies, business travel, home office expenses, and more. However, to claim these deductions, you need to have clear records of both your income and your expenses.

Check stubs can help you track any deductions that may have been applied to your income before tax. For example, if you use a check stub maker to track earnings from freelance projects, you can also note down any expenses related to that project—such as the cost of materials, tools, or even marketing efforts.

Having this kind of detailed breakdown of income and expenses can help you maximize your deductions come tax time, reducing your overall tax burden.

4. Documenting Payments for Estimated Taxes

As a self-employed individual, you are responsible for making estimated tax payments throughout the year. These payments are typically made quarterly and cover both income tax and self-employment tax (Social Security and Medicare). It can be tricky to estimate how much you should pay each quarter, especially if your income fluctuates.

Check stubs can be helpful in this process by providing a record of your earnings, making it easier to estimate how much tax you need to pay. For example, if you generate a check stub for each project or gig you complete, you’ll have a better understanding of how much income you’ve earned during the quarter. This can help you make more accurate estimated tax payments, avoiding underpayment penalties.

5. Providing Proof of Income for Tax Deductions

Certain tax deductions are only available if you can prove that you’ve earned a certain amount of income. For example, when claiming the home office deduction, the IRS requires proof that your business is legitimate and that you’ve earned income from it.

Check stubs are an excellent way to demonstrate the legitimacy of your business and your income. By keeping a detailed record of every payment you receive through check stubs, you can provide proof of income if you’re audited or need to validate your tax deductions. This documentation can be especially helpful for freelance workers or entrepreneurs who may need to show their income sources in detail.

6. Simplified Record Keeping for Audits

No one likes to think about being audited, but if it happens, it’s important to have well-organized financial records. One of the key reasons self-employed individuals get audited is because of poor documentation or discrepancies between reported income and deductions.

Using check stubs as part of your record-keeping system can make the audit process much easier. If the IRS requests information about your income or expenses, you can provide a neat, organized set of check stubs that show exactly how much you earned, what deductions you’ve claimed, and any other necessary financial details. This level of organization can help you avoid penalties or fines that might arise from improper record-keeping.

7. Tax Software Integration

Many self-employed individuals use tax software to file their returns. These platforms often have tools for tracking income and expenses and generating tax reports, but the accuracy of the final tax return depends on how well you’ve organized your financial records.

Check stubs can be integrated with most accounting or tax software programs. You can upload your check stubs directly into your accounting software, and the software can use that information to generate detailed reports. This helps you avoid manual entry errors and reduces the time spent organizing your financial data.

By having your check stubs already available in digital format, you can seamlessly transfer that information to your tax software and avoid common mistakes that can result in an incorrect tax return.

8. Professional Appearance for Clients and Contractors

If you work with clients or other contractors, issuing check stubs to document your payments can enhance your professionalism. While it’s not strictly necessary, providing check stubs shows that you take your business seriously and that you’re organized when it comes to managing your finances.

Not only will this professional appearance make clients more likely to hire you again, but it can also ensure that you have the proper documentation for your own tax purposes. For instance, if a client asks for proof of payment or income verification, you can simply provide a copy of the check stubs associated with the payment.

Conclusion

Managing taxes as a self-employed individual can be daunting, but using check stubs to document income, track deductions, and organize your financial records can make the process much easier. These stubs serve as a detailed record of earnings, help separate business and personal income, and ensure that you can claim every available deduction.

Free Check stubs can also provide essential documentation if you’re ever audited, help you track estimated tax payments, and integrate with tax software to streamline your filing process. Whether you’re a freelancer, contractor, or small business owner, incorporating check stubs into your financial management system can reduce your stress around tax season and help you stay organized throughout the year.

By leveraging check stubs for tax filing, you’re not only making the process easier, but you’re also ensuring that you are compliant, efficient, and maximizing your deductions. So, start using check stubs today to simplify your tax filing process and gain greater control over your finances as a self-employed individual!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

Leave a Reply