Managing payroll is a critical responsibility for every business, big or small. It’s a process that involves not only paying employees accurately and on time but also ensuring compliance with federal and state tax laws, tracking hours worked, handling deductions, and maintaining detailed records. This can be an overwhelming task, especially for business owners who are juggling multiple responsibilities. Fortunately, technology has made this process easier and more efficient.

A paystub creator is one such tool that can streamline the payroll process, saving you time and reducing the risk of costly errors. Whether you’re running a small business or managing payroll for a larger company, using the right paystub creator can transform how you handle payroll tasks. In this blog, we’ll explore what a paystub creator is, how it can simplify your payroll, and why every business should consider using one.

What is a Paystub Creator?

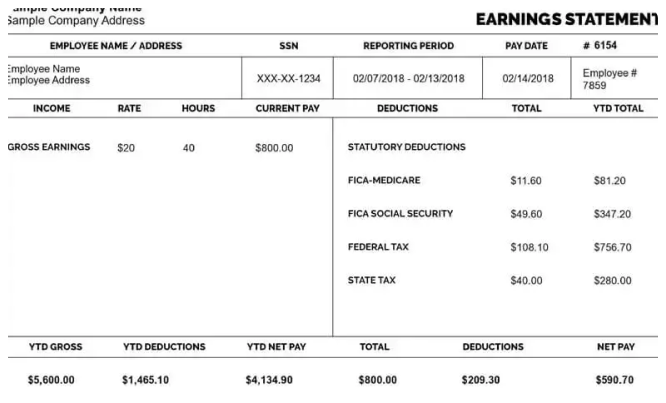

A paystub creator is an online tool or software that helps you generate pay stubs for your employees quickly and accurately. A pay stub, also known as a paycheck stub, is a document that outlines an employee’s earnings for a specific pay period. It includes crucial information such as:

- Gross pay: The total amount earned before any deductions (this can be hourly, salaried, or based on commission).

- Deductions: These include federal, state, and local taxes, Social Security contributions, health insurance premiums, retirement contributions, and any other voluntary deductions.

- Net pay: The amount the employee takes home after all deductions are subtracted from their gross pay.

- Other details: This may include the employee’s name, the employer’s name, the pay period, hours worked (for hourly employees), and overtime, if applicable.

A paystub creator automates the process of generating pay stubs, removing much of the manual work and complexity from payroll management. It ensures accuracy by calculating deductions and taxes based on current rates and business rules.

The Challenges of Payroll Management

Managing payroll is more than just cutting checks. There are several challenges that businesses face in ensuring employees are paid correctly, on time, and in compliance with all regulations:

1. Complex Tax Calculations

Payroll involves various tax calculations at the federal, state, and local levels. In addition to these taxes, businesses also need to calculate Social Security and Medicare contributions, retirement plan contributions, and other deductions. Keeping track of all these figures manually can be cumbersome and prone to errors.

2. Employee Classifications

Employees may be full-time, part-time, or temporary, and each category may have different pay structures, benefits, and deductions. Misclassifying employees can result in payroll mistakes and even legal complications.

3. Overtime and Bonuses

Overtime pay and bonuses need to be accurately calculated and factored into pay stubs. Depending on the employee’s status and local laws, overtime pay may vary, and bonuses may not be paid consistently. Keeping track of these additional components manually can be time-consuming and prone to error.

4. Time Consuming

For many small businesses, payroll is still processed manually or using basic tools like spreadsheets. This can be a time-consuming process, especially when dealing with multiple employees. Errors can result from rushed or complex calculations, or from not having the right information at hand.

5. Legal Compliance

Payroll compliance is essential, as the laws governing payroll taxes, employee classifications, and benefits can be complex. Failing to comply can lead to fines, back payments, and legal consequences.

How a Paystub Creator Can Streamline Payroll

A paystub creator can help solve many of these payroll challenges by automating tasks and simplifying the payroll process. Here’s how:

1. Accurate Calculations

A good paystub creator ensures accurate calculations of gross pay, taxes, deductions, and net pay. These tools automatically apply the most current tax rates and deduction amounts based on the information you enter, so you don’t have to worry about making manual calculations.

For example, if an employee works overtime, the paystub creator will automatically calculate the overtime rate and ensure it’s added to the total pay. Similarly, it will factor in any bonuses, commissions, or other incentive pay, ensuring the amounts are correctly reflected in the pay stub.

2. Saves Time

By using a paystub creator, you can generate pay stubs for all your employees in minutes. These tools often allow you to input employee data in bulk and generate multiple pay stubs at once, significantly reducing the time it would take to manually create pay stubs for each employee. With everything automated, you can focus on running your business instead of worrying about payroll.

3. Ensures Legal Compliance

Staying compliant with payroll laws is crucial. A paystub creator helps ensure that all required information is included on each pay stub, such as the correct tax deductions, the employee’s total hours worked, and any overtime pay. Most paystub creators are updated regularly to reflect changes in tax laws, so you can be confident that your pay stubs meet all legal requirements.

For example, in some states, employers are required to show the total number of hours worked, the hourly rate, and any deductions related to the state. A paystub creator ensures these details are included, making it easier for you to comply with both federal and state regulations.

4. Reduces Errors

Manual payroll processing is prone to errors, especially when working with complex deductions, benefits, and overtime calculations. A free paystub creator minimizes the risk of human error by automating calculations and using pre-built templates that include all the necessary components of a pay stub. This way, you won’t miss any important deductions or make any costly payroll mistakes that could affect employee satisfaction or lead to fines from the IRS.

5. Professional Pay Stubs

A paystub creator generates pay stubs that are professional and easy to understand. Most tools offer customizable templates that allow you to add your business logo, change the design to match your company’s branding and adjust the layout for clarity. This professional appearance gives employees confidence that their pay is being handled correctly and that the business is well-organized.

6. Employee Access

A paystub creator often allows employees to access their pay stubs online, which can be convenient and useful for their personal record-keeping. Instead of having to manually print and distribute physical pay stubs, employees can download their pay stubs in PDF format from an online portal. This reduces paper waste, makes access easier for employees, and provides a secure record of each pay period.

7. Cloud-Based Storage

Many paystub creators offer cloud-based storage, allowing you to keep a digital record of every pay stub you generate. This is much more efficient than storing physical copies or relying on spreadsheets. Cloud storage also provides security, ensuring that your payroll records are protected and easily accessible whenever needed.

How to Choose the Right Paystub Creator

When choosing a paystub creator, there are several factors to consider to ensure it meets your business needs:

1. Ease of Use

The tool should be user-friendly, even for those who aren’t familiar with payroll processes. Look for an intuitive interface that allows you to input data quickly and easily.

2. Customization

Your pay stubs should reflect your brand, so choose a paystub creator that allows for customization. You should be able to add your business logo, change the template’s colors, and modify other details to make it fit your company’s style.

3. Security

Payroll data is sensitive, so it’s essential to choose a paystub creator that uses secure encryption and protects employee information. Make sure the tool complies with data protection laws and offers secure cloud storage options.

4. Integration with Other Tools

Some paystub creators integrate with other payroll or accounting software, which can save you time and reduce the chances of mistakes. If you already use tools like QuickBooks, Xero, or Gusto for payroll, look for a paystub creator that integrates with them.

5. Customer Support

Good customer support is essential, especially if you encounter any issues while generating pay stubs. Choose a provider that offers reliable customer service via email, chat, or phone.

6. Pricing

Most paystub creators offer subscription plans, so compare pricing to see which option offers the best value for your business. Many tools offer a pay-as-you-go model, allowing you to only pay for what you use.

Conclusion

Using the right paystub creator can significantly streamline your payroll process, saving you time and reducing the risk of errors. By automating calculations, ensuring compliance, and providing professional pay stubs, a paystub creator simplifies the often complex and time-consuming task of managing payroll.

For small businesses, startups, or even larger companies, the time and cost savings associated with using a paystub creator can be substantial. With the right tool, you can ensure accurate, timely payroll while staying compliant with tax laws and making the payroll process more efficient for everyone involved. Whether you’re managing one employee or hundreds, a paystub creator can help you streamline your payroll system and keep your business running smoothly.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply