Using SharkShop to Build a Credit Score That Opens Doors

Are you ready to unlock a world of opportunities? Imagine having the financial freedom to secure your dream home, land that perfect job, or snag lower interest rates on loans—all thanks to a stellar credit score. Enter SharkShop.biz your ultimate ally in navigating the often murky waters of credit building.

In this blog post, we’ll dive deep into how SharkShop can empower you to improve your credit score and transform it from an intimidating number into a powerful tool for success. Whether you’re just starting out on your financial journey or looking to fine-tune your existing credit profile, we’ve got you covered with tips, tricks, and insights that will help turn those closed doors into open ones. Let’s jump in!

Introduction to SharkShop and its benefits for building credit score

In today’s fast-paced financial world, your credit score can feel like the golden ticket to unlocking new opportunities. Whether you’re dreaming of buying a home, getting that perfect car loan, or simply want to enjoy lower interest rates, having a robust credit score is essential. Enter SharkShop, an innovative platform designed not just to help you track your credit but actively improve it too.

Imagine building a solid credit history while enjoying the perks of online shopping—sounds intriguing? SharkShop.biz makes this possible by turning everyday purchases into stepping stones for better financial health. With its unique approach and user-friendly interface, you’ll be well on your way to enhancing your credit profile in no time. Let’s dive deeper into how SharkShop can open doors for you and transform the way you think about building credit!

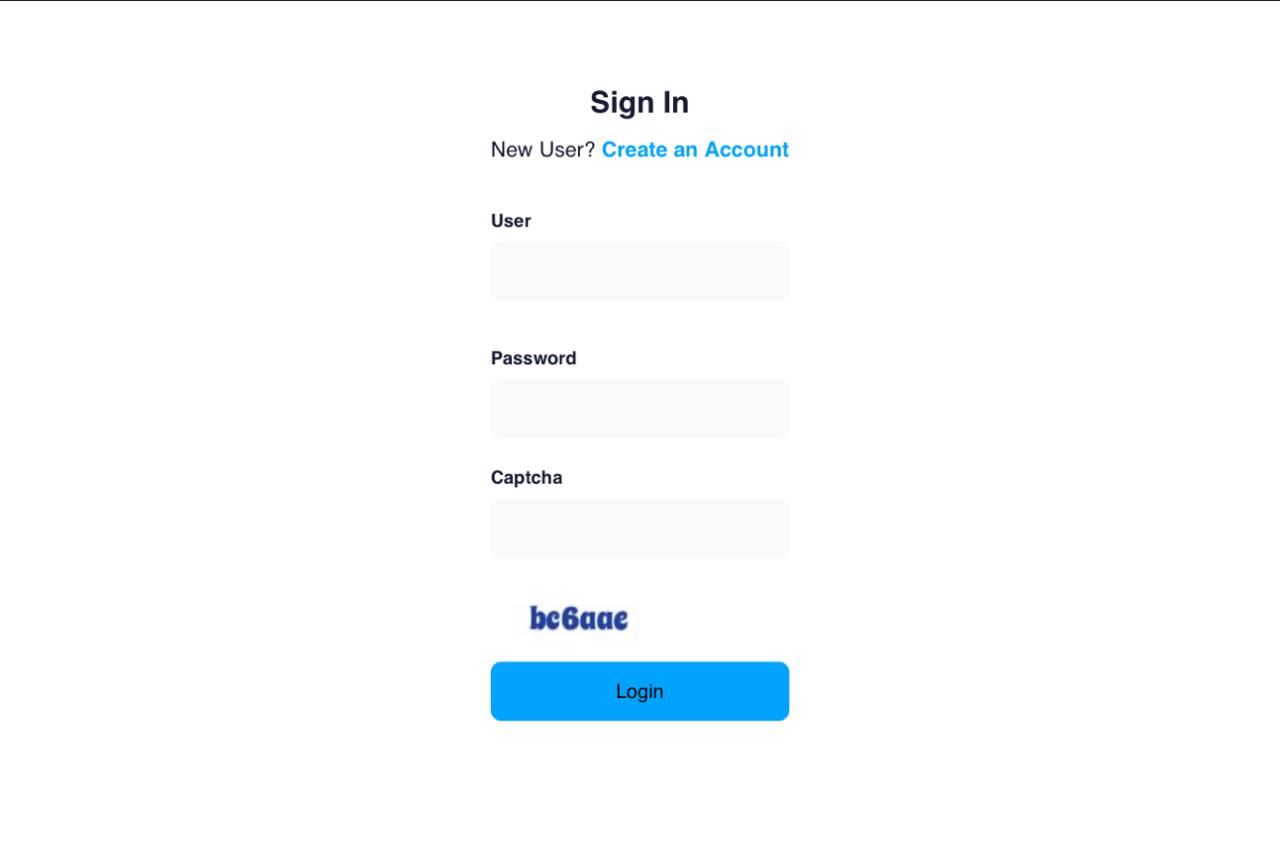

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding the importance of a good credit score

A good credit score is more than just a number. It’s a key that unlocks many doors in your financial journey. Whether you’re applying for a loan, renting an apartment, or seeking lower insurance premiums, lenders and landlords often rely on this score to gauge your reliability.

With a strong credit score, you can access better interest rates. This means saving money over time on loans and mortgages. People with higher scores are viewed as less risky by creditors.

Conversely, a poor credit rating can lead to missed opportunities. It may result in higher borrowing costs or difficulty securing rental agreements. Understanding the significance of maintaining good credit habits is essential for long-term financial health and stability.

Investing effort into building your score pays off significantly down the line when it comes to achieving your goals and dreams.

How SharkShop works to improve your credit score

SharkShop takes a smart approach to boost your credit score. First, it analyzes your financial habits and identifies areas for improvement. By understanding your spending patterns, SharkShop helps you make more informed decisions.

Next, the platform connects with various lenders and banks. This allows users to secure credit-building opportunities tailored to their needs. Whether it’s a secured card or small personal loans, SharkShop opens new doors for responsible borrowing.

Another key feature is its real-time updates on your progress. Users receive alerts about changes in their score, giving them insights into what actions are effective.

Moreover, SharkShop educates users on best practices for maintaining good credit health. With tips and resources at hand, managing finances becomes less daunting and more rewarding over time.

Tips for using SharkShop effectively to maximize results

To get the most out of SharkShop, start by setting clear goals. Define what you want to achieve with your credit score. This clarity will guide your actions.

Next, regularly monitor your progress within the platform. Keep track of changes in your credit score and understand how different activities influence it. This real-time feedback is invaluable.

Engage actively with SharkShop’s educational resources. The more you know about credit management, the better choices you’ll make. Knowledge empowers you to navigate challenges effectively.

Don’t hesitate to utilize customer support when needed. Their team can provide personalized advice tailored to your unique financial situation.

Lastly, stay consistent in using SharkShop’s features—regularly manage payments and debts through their interface for sustained improvement over time. Consistency breeds results in building a robust credit profile.

Real-life success stories from SharkShop users

SharkShop login has transformed the credit journeys of many users. Take Maria, for instance. After struggling with low credit scores for years, she discovered SharkShop and decided to give it a try. Within six months, her score jumped 100 points! She was finally able to secure a car loan at an interest rate that didn’t break the bank.

Then there’s Jake. He was hesitant about using any services but took the plunge with SharkShop after hearing positive feedback from friends. It guided him through managing his debts more effectively, leading him to qualify for a mortgage sooner than he expected.

These stories highlight how SharkShop is not just about numbers; it’s about real people achieving their dreams by improving their financial health and gaining confidence in their spending power. Each success is unique yet relatable—a testament to what careful management can achieve when partnered with the right tools.

Other features and services offered by SharkShop

SharkShop goes beyond just credit score building. It offers budgeting tools to help users manage their finances more effectively. These features allow you to track spending habits and set savings goals, creating a clearer picture of your financial health.

Another standout service is the credit education resources available within the platform. Users can access articles, videos, and webinars that cover various aspects of personal finance and credit management. This knowledge empowers individuals to make informed decisions.

SharkShop also provides personalized alerts for bill payments and upcoming due dates. Staying on top of these responsibilities significantly reduces the risk of missed payments, which can harm your credit score.

Additionally, SharkShop connects users with financial advisors who offer tailored advice based on individual situations. This level of support is invaluable as it guides users toward making sound financial choices while working on their credit scores.

Additional resources for building credit score outside of SharkShop

Building your credit score involves more than just using SharkShop cc. There are several other resources to explore.

Credit counseling services can provide personalized guidance. These professionals help you understand your financial situation and create a plan for improvement.

Another option is online courses focused on credit education. Websites like Credit Karma or MyFICO offer valuable insights into managing finances effectively.

You might also consider securing a secured credit card. This type of card requires a cash deposit, which serves as collateral but helps build your score with responsible use.

Monitoring your credit report regularly is essential too. You can access free reports annually from AnnualCreditReport.com, allowing you to catch any discrepancies early.

Utilize budgeting apps as well; they help track spending and encourage smart financial habits that contribute positively to your overall score over time.

Conclusion: Why SharkShop is the best tool for improving your credit score and opening doors for financial opportunities.

SharkShop.biz stands out as a powerful tool for anyone looking to improve their credit score. Its user-friendly platform simplifies the process, making it accessible even for those who may not be financially savvy. With its innovative features, SharkShop helps users understand their credit situation and provides actionable insights tailored to individual needs.

The importance of a good credit score cannot be overstated. It affects everything from loan approvals to interest rates on mortgages. By utilizing SharkShop’s resources effectively, individuals can navigate this crucial aspect of financial health with confidence and ease.

Real-life success stories highlight the transformative power of SharkShop. Users have reported significant improvements in their scores within mere months, which has opened new doors for them—whether that means qualifying for better loans or securing favorable rental agreements.

Beyond just improving your credit score, SharkShop offers various tools and resources designed to enhance your overall financial literacy. This comprehensive approach empowers users not only to achieve immediate goals but also to maintain long-term financial wellness.

For those seeking additional support outside of SharkShop, numerous resources are available online—from educational articles about managing personal finances to community forums where you can share experiences and tips with others on similar journeys.

With all these factors combined, it’s clear why many choose SharkShop as their go-to solution for building a robust credit profile. Embracing what it offers can truly pave the way toward greater financial opportunities and security in life.

Leave a Reply